Forget everything you know about life insurance. Say goodbye to hundred-page application forms, endless phone calls, scary needles, expensive premiums and 50-year contracts. Gone are the days of greedy insurers whose complex products allow them to eke out profits, without you knowing and at your expense. And say hello to a completely new type of life insurance model - one that’s smart, instant, easy, transparent, and has crazy low premiums.

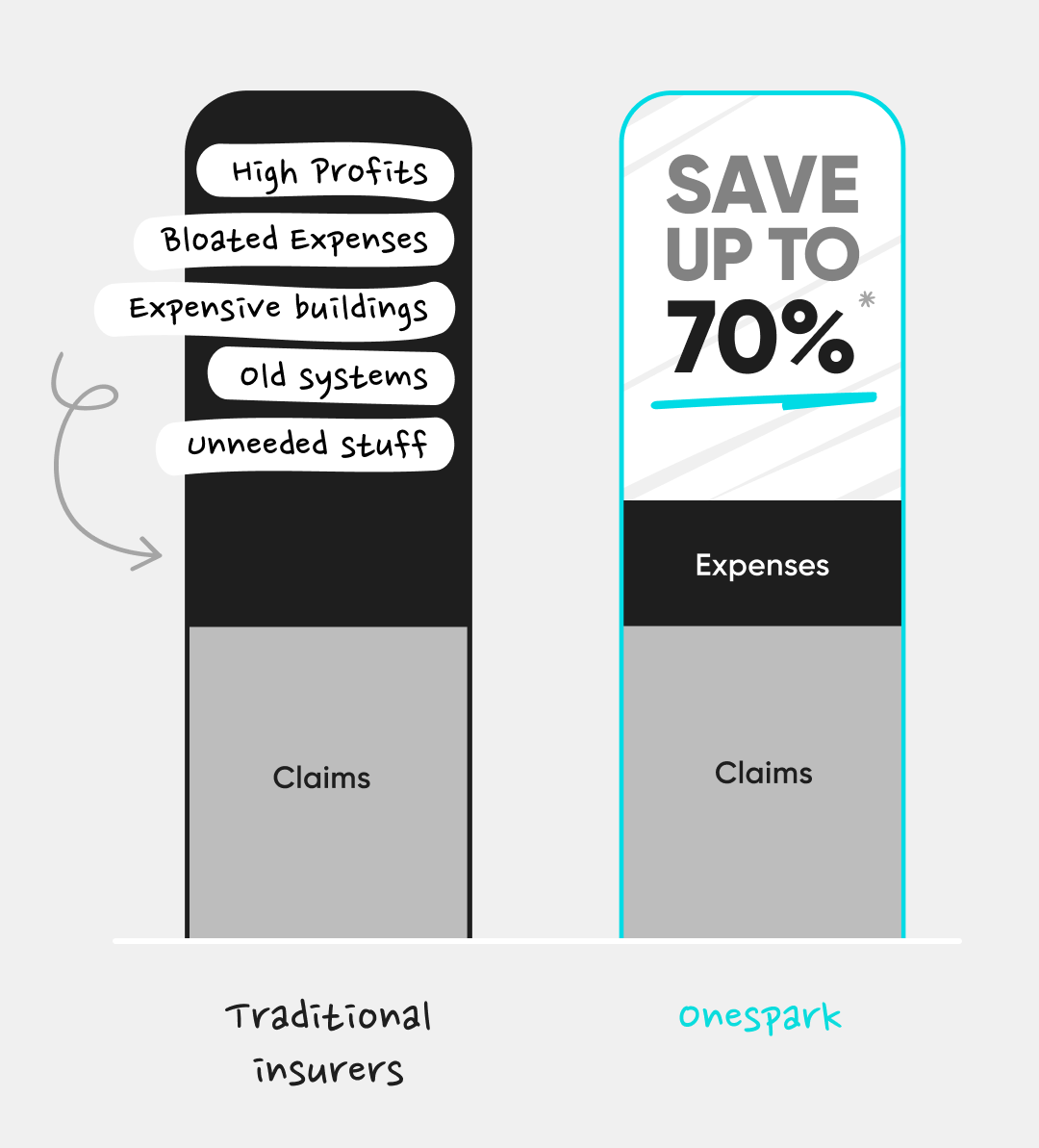

“At OneSpark, we know how hard you have worked to earn every cent, that’s why treat the premiums you pay as if it’s your money, not ours. We replaced the bloated expenses, large profits and archaic processes with smart tech and powerful AI. Plus, we do life insurance completely differently. We simply take a small fee to administer your policy, pay out claims in times of need and return to you whatever premiums that are left over. This means you can save you up to 70% compared to other life insurers.” Says Josh Kaplan, co-founder and joint CEO of OneSpark.

Currently, at other life insurers, only approximately 40% of your premium actually goes towards paying out your claims. By embedding smart tech and powerful AI into the foundation of their product, and by creating the world’s first Pay-As-You-Need and Peer-to-Peer life insurance model, OneSpark has almost doubled this to 70%. This doubling of the efficiency of traditional life insurance, results in massive premium savings for clients.

“We worked hard to make the most efficient and smartest life insurance structure in the world, and to channel all that value back to our clients, our number one priority”. Says Francis Gill, Head of Actuarial at OneSpark.

Traditional life insurance also requires you to lock into an inflexible long-term contract. In reality, your needs are constantly changing, such as your debt levels, income, occupation, lifestyle and family make-up. Regardless of the fact that your needs change every year, with traditional life insurance you’re locked into a static policy that remains level in real terms.

“At the moment, traditional life insurance is analogous to locking into a contract to buy the exact same white t-shirt every year for the rest of your life, regardless of how your body changes, materials advance, colour preferences and styles change. It just doesn’t make sense anymore. That’s why our world-first Pay-As-You-Need life insurance model uses powerful AI to automatically adjust your cover every year in line with your changing needs, so you’re no longer locked into a 50-year contract. It’s a short-term contract that dynamically adjusts as your life evolves, so you can just sit back, relax and spend time on the things that matter most”, says Greg Smith, co-founder and Joint CEO of OneSpark.

In today’s world, where you can get from one side of the globe to the other in hours, it shouldn’t take weeks to take get covered, require painful medical tests and the completion of long, complicated forms. At the moment, you need a rocket science degree to understand the product and figure out much cover you need every year. OneSpark’s advanced machine learning and AI algorithms mean you can get a quote in 10 seconds, get covered in minutes without any painful medical tests, and all while it tells you exactly how much cover you need every year in order to be fully protected.

We're on a mission to make life insurance instant, easy, and transparent. Our Pay-As-You-Need Life Insurance, and powerful AI, do just that.